-

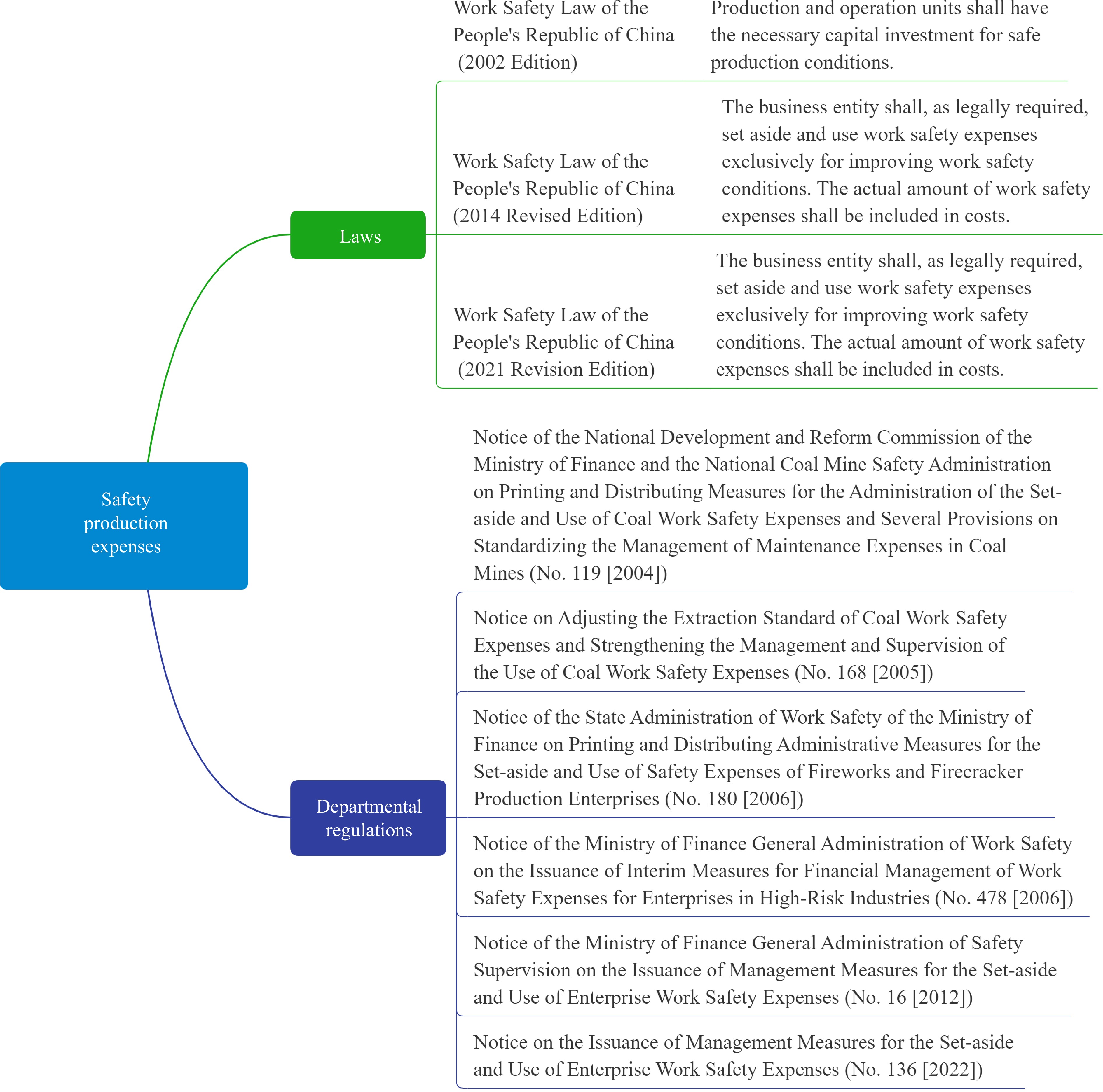

Figure 1.

Relevant laws and regulations on enterprise work safety expenses.

-

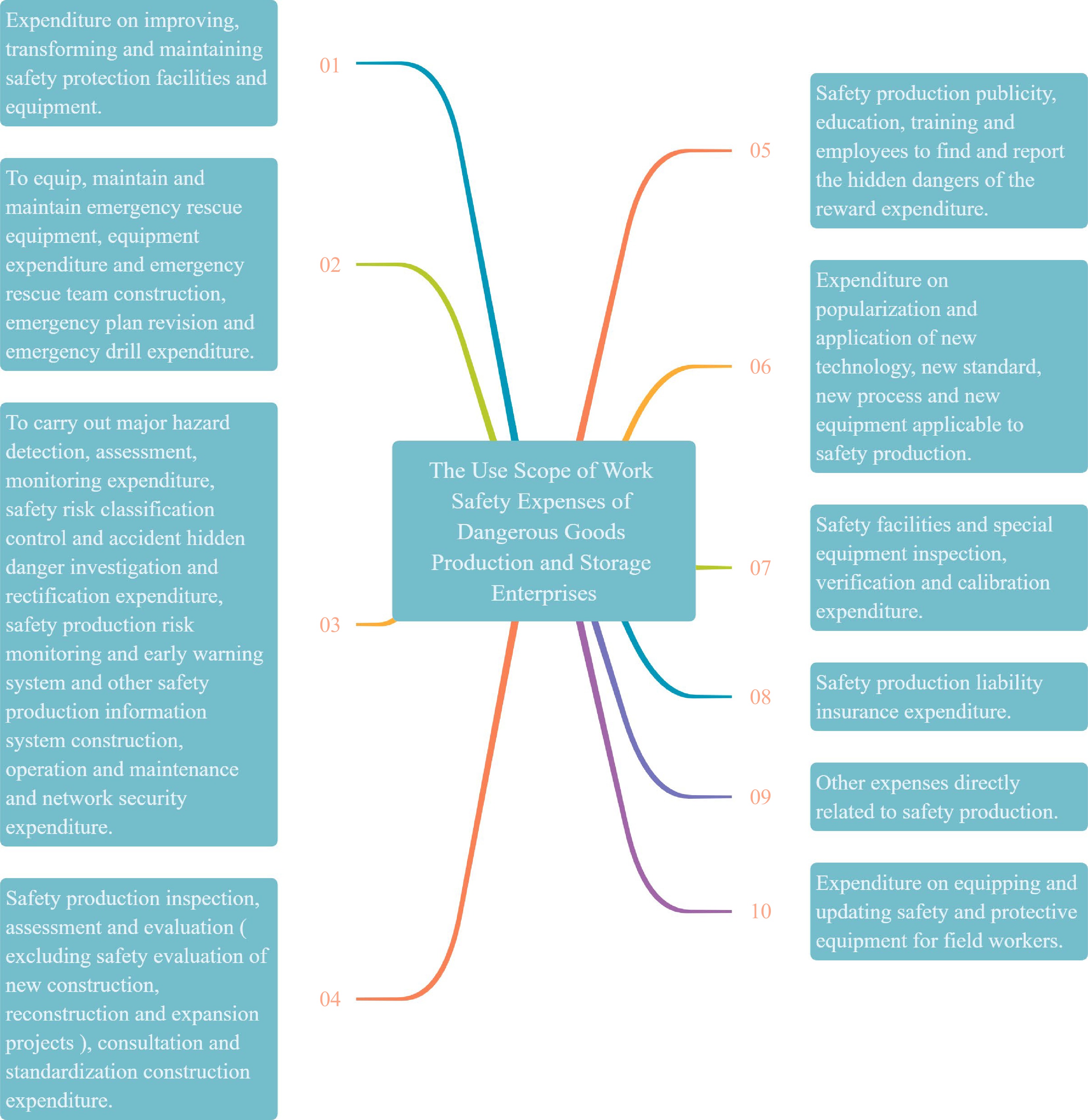

Figure 2.

Use scope of work safety expenses of dangerous goods production and storage enterprises.

-

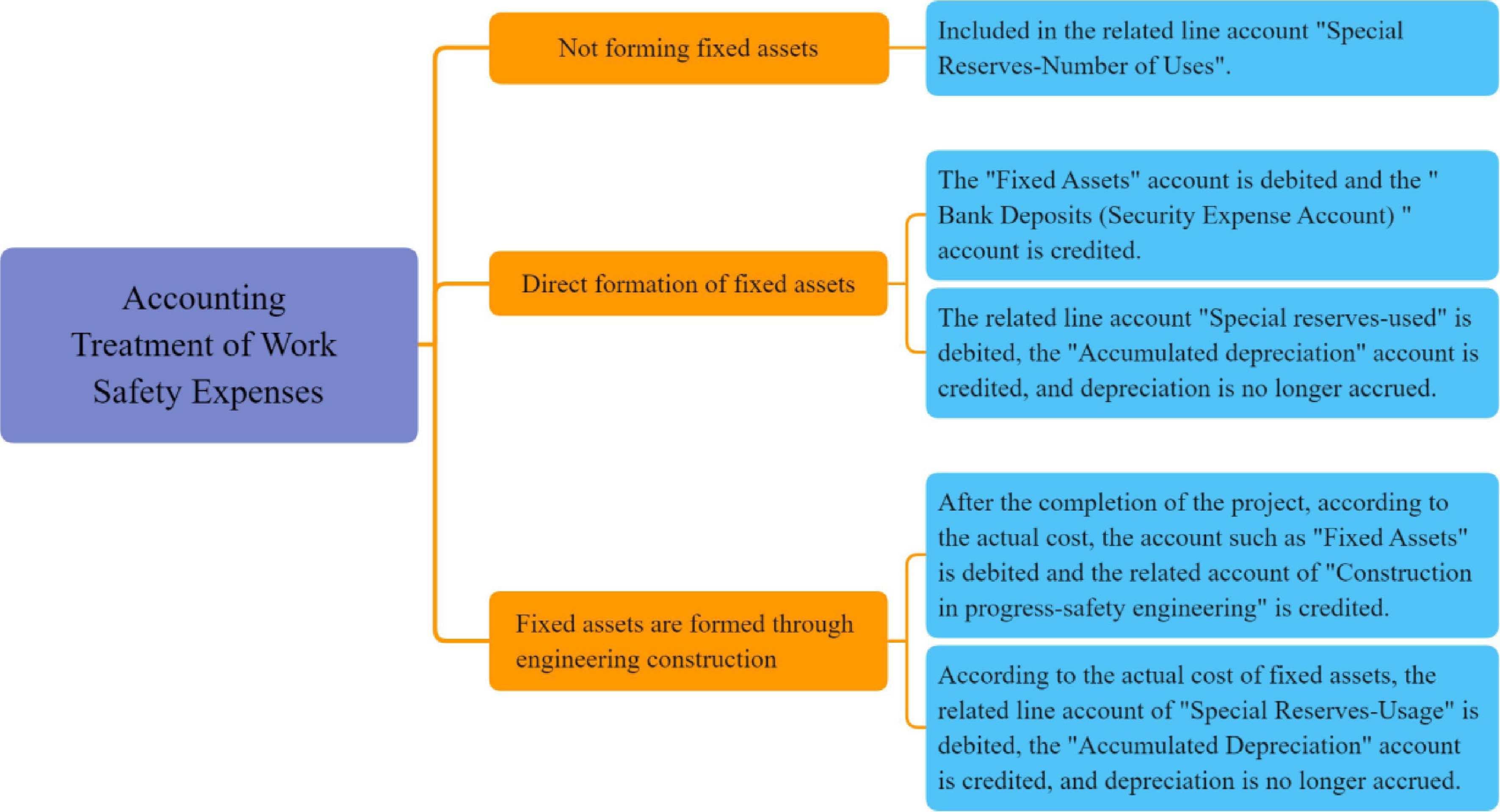

Figure 3.

Three accounting treatment methods of work safety expenses.

-

No. Type of enterprise Set-aside basis Set-aside time Remarks 1 Coal production enterprises Output of raw coal mined for the month End of month 2 Non-coal mining enterprises Production of raw ore mined during the month End of month 3 Oil and gas exploitation enterprises Amount of oil and natural gas produced in the month End of month Onshore oil (gas) or offshore oil (gas) production enterprises Direct engineering cost in the cost of a project or project Monthly set-aside Drilling, geophysical exploration, logging, logging, down hole operations, oil construction, offshore engineering and other enterprises 4 Construction project construction enterprises Construction and installation cost End of month Calculated according to the progress of the project 5 Dangerous goods production and storage enterprises Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regressive 6 Transportation enterprise Operating income of the previous year Average withdrawals month by month Determine the amount payable for the current year 7 Metallurgical enterprise Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regression 8 Machinery manufacturing enterprise Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regressiion 9 Fireworks and firecracker production enterprises Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regression 10 Civil explosive products production enterprises Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regression 11 Weapon equipment development, production and testing enterprises Military sales revenue for the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regression 12 Electric power production and supply enterprises Operating income of the previous year Average withdrawals month by month Amount payable for the current year shall be determined using excess regression Table 1.

Set-aside standard and time of work safety expenses of different types of enterprises.

-

No. Relationship between the amount withdrawn (x) and the amount used (y) Methods of handling work safety expenses 1 y < 0.6x 1) Information disclosure in accordance with regulations;

2) Before the end of April of the next year, in accordance with the territorial supervision authority, it shall submit a written explanation to the department responsible for supervision and administration of production safety under the people's government at or above the county level for deliberation by the board of directors, shareholders' meetings and other organs of the enterprise.2 0.6x ≤ y < x Carried forward to the next year. Table 2.

Work safety expense balance processing.

Figures

(3)

Tables

(2)